Edge Computing Market Size, Share & Trends Analysis Report By Technology (Mobile Edge Computing, Fog Computing), By Vertical, By Organization Size, By Region, And Segment Forecasts, 2018 - 2025

Industry Outlook

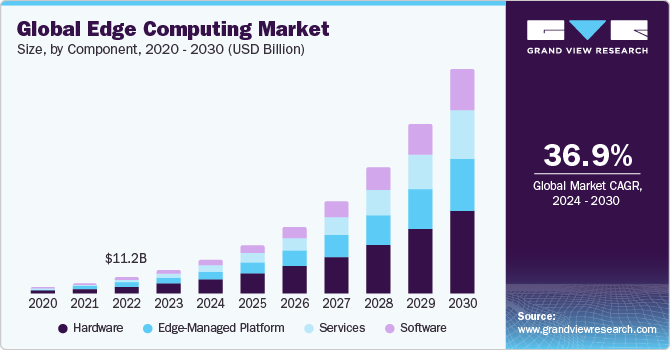

The global edge computing market size was valued at USD 158.3 million in 2016. IoT data is continuously increasing due to introduction of smart devices such as smart glasses and smart watches. Edge computing helps in collecting, processing, and storing the IoT-generated data.

Additionally, rise in the number of internet users and rapid adoption of digital services have led to an exponential increase in the volume of sensitive data collected by organizations.This further increase in data is expected to accelerate the adoption of the edge computing.

Increasing emphasis on cost and time management, growing IoT data, soaring need for automation of businesses, and burgeoning competitive rivalry have significantly boosted the demand for edge computing. The technology helps enterprises in gaining real-time insights and improving the effectiveness of their decision-making process for maximizing profit.However, data privacy and security concerns can hinder the market growth.

The North America market has seen a broader adoption of edge computing solutions across all verticals in recent times. The region has been an early adopter of new innovative technologies coupled with presence of significant technology players. Moreover, availability of better technology infrastructure and reliable network connectivity across the region has encouraged the growth of the market.

Report Coverage & Deliverables

- Competitive benchmarking

- Market forecasts

- Company market shares

- Market opportunities

- Latest trends & dynamics

Vertical Insights

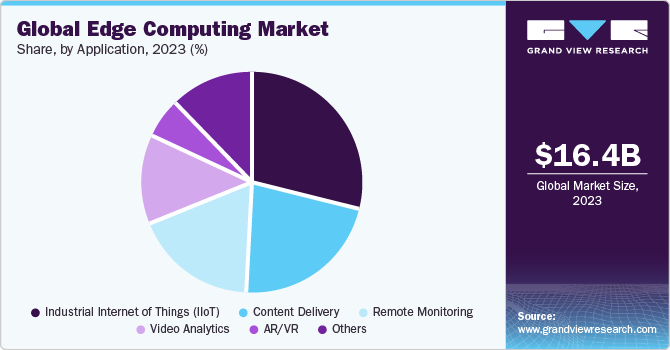

Edge computing solutions are widely adopted across the manufacturing sector owing to surging adoption of IoT devices in factories and automotive industries. Manufacturing enterprises are opting for these solutions to lower capital investments since data is processed at the edge of the network. Additionally, the IT & telecom segment is anticipated to contribute toward the growth of the market. As the number of telecom subscribers is increasing, so is the use of edge computing solutions as they can help improve network efficiency and enhance service quality.

The healthcare & life sciences segment is anticipated to be the fastest-growing segment over the forecast period. Internet of Things (IoT) technologies have started penetrating the healthcare sector, which has enabled the development of smart healthcare solutions. Edge computing provides real-time screening of the patient and also avoids delays, thus driving the demand for the technology in the healthcare & life sciences segment.

Organization Size Insights

The SMEs segment is estimated to expand at the highest CAGR over the forecast period owing to increasing need for cost optimization and automation in various sectors. Additionally, due to easy availability and declining costs of cloud-based technologies, SMEs are increasingly storing a large amount of data on cloud platforms. This, in turn, is poised to boost the demand for edge computing solutions among SMEs over the forecast period.

The large enterprises segment dominated the market in 2016 and the trend is estimated to continue over the forecast period. Large companies have many operating units and abundant capital to invest in various edge computing solutions as compared to other SME organizations.

Technology Insights

The mobile edge computing segment dominated the market in 2016, a trend that is likely to continue over the forecast period. Technological innovations in the telecommunications sector have paved way for 5G network, which requires high bandwidth and low latency that are provided by edge computing solutions. Thus, the factor is contributing to the growth of the segment.

The fog computing segment is projected to register the highest CAGR owing to the spiraling usage of connected devices. Additionally, rising need for real-time computing, machine-to-machine communication, and IoT connectivity are some of the factors driving the edge computing market.

Regional Insights

North America dominated the market in 2016 andis expected to lead until 2025. The region has many prominent technology companies such as Amazon Web Services, Inc. (AWS), Google, and Hewlett Packard Enterprise Development LP. The region will witness significant growth owing to high concentration of manufacturing and telecommunication industries that majorly adopt edge computing services and solutions. Additionally, proliferation of digital services and technological advancements coupled with early adoption of the latest technologies in various sectors such as healthcare & life sciences, transportation & logistics, consumer appliances are supplementing the growth of the region.

However, Asia Pacific is anticipated to be the most promising regional market with a CAGR of 46.7% over the forecast period. Government initiatives to promote digitization and advanced infrastructure are propelling the regional market. Besides this, rising adoption of smart devices and growing investments in cloud and IoT technologies are estimated to be the key factors stimulating growth of the region. Furthermore, countries such as China and Japan are poised to be the sights of high growth rates in APAC. Surging use of internet and social media in these countries is fueling the demand for edge computing in the region.

Edge Computing Market Share Insights

The market is highly competitive in nature. Some of the prominent companies operating in the market are Aricent, Inc.; Amazon Web Services, Inc. (AWS); Cisco Systems, Inc.; General Electric; Hewlett Packard Enterprise Development LP; Huawei Technologies Co.; Ltd.; International Business Machines (IBM); Intel Corporation; Microsoft; and SAP SE.

Players are adopting strategies such as product upgradation, new product development, expansion, mergers & acquisitions, and partnerships to expand their product portfolios and strengthen foothold in the market. For instance, in October 2016, Hewlett Packard Enterprise Development LP and PTC entered into a collaboration for facilitating the development of converged IoT solutions that were based on HPE Edgeline Systems and PTC ThingWorx software. They have increased their R&D spending to develop new and innovative solutions and differentiated products for the market.

Report Scope

|

Attribute |

Details |

|

Base year for estimation |

2016 |

|

Forecast period |

2017 - 2025 |

|

Market representation |

Revenue in USD Million & CAGR from 2017 to 2025 |

|

Regional scope |

North America, EMEA, Asia Pacific, and Latin America |

|

Country scope |

U.S., Canada, Germany, U.K., China, and Japan |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

15% free customization scope (equivalent to 5 analysts working days) |

If you need specific market information that is not currently within the scope of the report, we will provide it to you as a part of the customization |

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2016 to 2025. For this study, Grand View Research has segmented the global edge computing market report based on vertical, organization size, technology, and regions:

-

Vertical Outlook (Revenue, USD Million, 2016 - 2025)

-

Manufacturing

-

Energy & Utilities

-

IT & Telecom

-

Healthcare & Life Sciences

-

Consumer Appliances

-

Transportation & Logistics

-

Others

-

-

Organization Size Outlook (Revenue, USD Million, 2016 - 2025)

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

-

-

Technology Outlook (Revenue, USD Million, 2016 - 2025)

-

Mobile Edge Computing

-

Fog Computing

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2025)

-

North America

-

U.S.

-

Canada

-

-

EMEA

-

U.K.

-

Germany

-

MEA

-

-

Asia Pacific

-

China

-

Japan

-

-

Latin America

-

Chapter 1 Methodology and Scope

1.1 Research Methodology

1.2 Research Scope and Assumptions

1.3 List of Data Sources

Chapter 2 Executive Summary

2.1 Edge Computing Market - Industry Snapshot & Key Buying Criteria, 2016 - 2025

2.2 Edge Computing Market, 2016 - 2025

Chapter 3 Edge Computing Market Industry Outlook

3.1 Market Segmentation

3.2 Market Size & Growth Prospects

3.3 Edge Computing Market - Value Chain Analysis

3.3.1 Market driver analysis

3.3.1.1 Delays and latency caused due to cloud technologies

3.3.1.2 Reduced cost and enhanced security

3.3.1.3 Increase in the number of smart applications

3.3.2 Market challenge analysis

3.3.2.1 Security and privacy concerns related to edge computing

3.4 Edge Computing Market - Porter’s Five Forces Analysis

3.5 Edge Computing Market - PEST Analysis

3.6 Edge Computing Market - Comparison Between Edge Computing and Cloud Computing

3.7 Edge Computing Market - Edge Computing Model

Chapter 4 Edge Computing Vertical Outlook

4.1 Edge Computing Market Share by Vertical, 2016 & 2025

4.2 Manufacturing

4.2.1 Edge computing market for manufacturing, 2016 - 2025

4.3 Energy & Utilities

4.3.1 Edge computing market for energy & utilities, 2016 - 2025

4.4 IT & Telecom

4.4.1 Edge computing market for IT & telecom

4.5 Healthcare & Life Sciences

4.5.1 Edge computing market for healthcare & life sciences, 2016 - 2025

4.6 Consumer Appliances

4.6.1 Edge computing market for consumer appliances, 2016 - 2025

4.7 Transportation & Logistics

4.7.1 Edge computing market for transportation & logistics, 2016 - 2025

4.8 Others

4.8.1 Edge computing market for others, 2016 - 2025

Chapter 5 Edge Computing Market Organization Size Outlook

5.1 Edge Computing Market Share By Organization Size, 2016 & 2025

5.2 Small & Medium Enterprises (SMEs)

5.2.1 Small & medium enterprises (SMEs) edge computing market, 2016 - 2025

5.3 Large Enterprises

5.3.1 Large enterprises edge computing market, 2016 - 2025

Chapter 6 Edge Computing Market Technology Outlook

6.1 Edge Computing Market Share by Technology, 2016 & 2025

6.2 Mobile Edge Computing

6.2.1 Mobile edge computing market, 2016 - 2025

6.3 Fog Computing

6.3.1 Fog computing market, 2016 - 2025

Chapter 7 Edge Computing Market Regional Outlook

7.1 Edge Computing Market Share By Region, 2016 & 2025

7.2 North America

7.2.1 North America edge computing market, 2016 - 2025

7.2.2 North America edge computing market, by vertical, 2016 - 2025

7.2.3 North America edge computing market, by organization size, 2016 - 2025

7.2.4 North America edge computing market, by technology, 2016 - 2025

7.2.5 U.S.

7.2.5.1 U.S. edge computing market, 2016 - 2025

7.2.5.2 U.S. edge computing market, by vertical, 2016 - 2025

7.2.5.3 U.S. edge computing market, by organization size, 2016 - 2025

7.2.5.4 U.S. edge computing market, by technology, 2016 - 2025

7.2.6 Canada

7.2.6.1 Canada edge computing market, 2016 - 2025

7.2.6.2 Canada edge computing market, by vertical, 2016 - 2025

7.2.6.3 Canada edge computing market, by organization size, 2016 - 2025

7.2.6.4 Canada edge computing market, by technology, 2016 - 2025

7.3 EMEA

7.3.1 EMEA edge computing market, 2016 - 2025

7.3.1.1 EMEA edge computing market, by vertical, 2016 - 2025

7.3.1.2 EMEA edge computing market, by organization size, 2016 - 2025

7.3.2 EMEA edge computing market, by technology, 2016 - 2025

7.3.3 U.K.

7.3.3.1 U.K. edge computing market, 2016 - 2025

7.3.3.2 U.K. edge computing market, by vertical, 2016 - 2025

7.3.3.3 U.K. edge computing market, by organization size, 2016 - 2025

7.3.3.4 U.K. edge computing market, by technology, 2016 - 2025

7.3.4 Germany

7.3.4.1 Germany edge computing market, 2016 - 2025

7.3.4.2 Germany edge computing market, vertical, 2016 - 2025

7.3.4.3 Germany edge computing market, by organization size, 2016 - 2025

7.3.4.4 Germany edge computing market, by technology, 2016 - 2025

7.3.5 MEA

7.3.5.1 MEA edge computing market, 2016 - 2025

7.3.5.2 MEA edge computing market, by vertical, 2016 - 2025

7.3.5.3 MEA edge computing market, by organization size, 2016 - 2025

7.3.5.4 MEA edge computing market, by technology, 2016 - 2025

7.3.6 Others

7.3.6.1 Others edge computing market, 2016 - 2025

7.3.6.2 Others edge computing market, vertical, 2016 - 2025

7.3.6.3 Others edge computing market, by organization size, 2016 - 2025

7.3.6.4 Others edge computing market, by technology, 2016 - 2025

7.4 Asia Pacific

7.4.1 Asia Pacific edge computing market, 2016 - 2025

7.4.1.1 Asia Pacific edge computing market, by vertical, 2016 - 2025

7.4.1.2 Asia Pacific edge computing market, by organization size, 2016 - 2025

7.4.2 Asia Pacific edge computing market, by technology, 2016 - 2025

7.4.3 China

7.4.3.1 China edge computing market, 2016 - 2025

7.4.3.2 China edge computing market, by vertical, 2016 - 2025

7.4.3.3 China edge computing market, by organization size, 2016 - 2025

7.4.3.4 China edge computing market, by technology, 2016 - 2025

7.4.4 Japan

7.4.4.1 Japan edge computing market, 2016 - 2025

7.4.4.2 Japan edge computing market, by vertical, 2016 - 2025

7.4.4.3 Japan edge computing market, by organization size, 2016 - 2025

7.4.4.4 Japan edge computing market, by technology, 2016 - 2025

7.5 Latin America

7.5.1 Latin America edge computing market, 2016 - 2025

7.5.1.1 Latin America edge computing market, by vertical, 2016 - 2025

7.5.1.2 Latin America edge computing market, by organization size, 2016 - 2025

7.5.2 Latin America edge computing market, by technology, 2016 - 2025

Chapter 8 Competitive Landscape

8.1 Aricent, Inc.

8.1.1 Company overview

8.1.2 Financial performance

8.1.3 Product benchmarking

8.2 Amazon Web Services, Inc. (AWS)

8.2.1 Company overview

8.2.2 Financial performance

8.2.3 Product benchmarking

8.2.4 Strategic initiatives

8.3 Cisco Systems, Inc.

8.3.1 Company overview

8.3.2 Financial performance

8.3.3 Product benchmarking

8.3.4 Strategic initiatives

8.4 General Electric

8.4.1 Company overview

8.4.2 Financial performance

8.4.3 Product benchmarking

8.4.4 Strategic initiatives

8.5 Hewlett Packard Enterprise Development LP

8.5.1 Company overview

8.5.2 Financial performance

8.5.3 Product benchmarking

8.5.4 Strategic initiatives

8.6 Huawei Technologies Co., Ltd.

8.6.1. Company overview

8.6.2. Financial performance

8.6.3. Product benchmarking

8.6.4. Strategic initiatives

8.7 International Business Machines (IBM)

8.7.1 Company overview

8.7.2 Financial performances

8.7.3 Product benchmarking

8.7.4 Strategic initiatives

8.8 Intel Corporation

8.8.1 Company overview

8.8.2 Financial performance

8.8.3 Product benchmarking

8.8.4 Strategic initiatives

8.9 Microsoft

8.9.1 Company overview

8.9.2 Financial performance

8.9.3 Product benchmarking

8.9.4 Strategic initiatives

8.10 SAP SE

8.10.1 Company overview

8.10.2 Financial performance

8.10.3 Product benchmarking

8.10.4 Strategic initiatives

List of Tables

TABLE 1 Edge computing market - industry snapshot & key buying criteria, 2016 - 2025

TABLE 2 Edge computing market, 2016 - 2025 (USD Million)

TABLE 3 Edge computing market, by region, 2016 - 2025 (USD Million)

TABLE 4 Edge computing market, by vertical, 2016 - 2025 (USD Million)

TABLE 5 Edge computing market, by organization size, 2016 - 2025 (USD Million)

TABLE 6 Edge computing market, by technology, 2016 - 2025 (USD Million)

TABLE 7 Edge computing - Key market driver impact

TABLE 8 Edge computing - Key market challenge impact

TABLE 9 Edge computing market for manufacturing, 2016 - 2025 (USD Million)

TABLE 10 Edge computing market for manufacturing, by region, 2016 - 2025 (USD Million)

TABLE 11 Edge computing market for energy & utilities, 2016 - 2025 (USD Million)

TABLE 12 Edge computing market for energy & utilities by region, 2016 - 2025 (USD Million)

TABLE 13 Edge computing market for IT & telecom, 2016 - 2025 (USD Million)

TABLE 14 Edge computing market for IT & telecom, by region, 2016 - 2025 (USD Million)

TABLE 15 Edge computing market for healthcare & life sciences 2016 - 2025 (USD Million)

TABLE 16 Edge computing market for healthcare & life sciences, by region, 2016 - 2025 (USD Million)

TABLE 17 Edge computing market for consumer appliances, 2016 - 2025 (USD Million)

TABLE 18 Edge computing market for consumer appliances, by region, 2016 - 2025 (USD Million)

TABLE 19 Edge computing market for transportation & logistics, 2016 - 2025 (USD Million)

TABLE 20 Edge computing market for transportation & logistics, by region, 2016 - 2025 (USD Million)

TABLE 21 Edge computing market for others, 2016 - 2025 (USD Million)

TABLE 22 Edge computing market for others, by region, 2016 - 2025 (USD Million)

TABLE 23 Small & medium enterprises (SMEs) edge computing market, 2016 - 2025 (USD Million)

TABLE 24 Small & medium enterprises (SMEs) edge computing market, by region, 2016 - 2025 (USD Million)

TABLE 25 Large enterprises edge computing market, 2016 - 2025 (USD Million)

TABLE 26 Large enterprises edge computing market, by region, 2016 - 2025 (USD Million)

TABLE 27 Mobile edge computing market, 2016 - 2025 (USD Million)

TABLE 28 Mobile edge computing market, by region, 2016 - 2025 (USD Million)

TABLE 29 Fog computing market, 2016 - 2025 (USD Million)

TABLE 30 Fog computing market, by region, 2016 - 2025 (USD Million)

TABLE 31 North America edge computing market, 2016 - 2025 (USD Million)

TABLE 32 North America edge computing market, by vertical, 2016 - 2025 (USD Million)

TABLE 33 North America edge computing market, by organization size, 2016 - 2025 (USD Million)

TABLE 34 North America edge computing market, by technology, 2016 - 2025 (USD Million)

TABLE 35 U.S. edge computing market, 2016 - 2025, (USD Million)

TABLE 36 U.S. edge computing market, by vertical, 2016 - 2025 (USD Million)

TABLE 37 U.S. edge computing market, by organization size, 2016 - 2025 (USD Million)

TABLE 38 U.S. edge computing market, by technology, 2016 - 2025 (USD Million)

TABLE 39 Canada edge computing market, 2016 - 2025, (USD Million)

TABLE 40 Canada edge computing market, by vertical, 2016 - 2025 (USD Million)

TABLE 41 Canada edge computing market, by organization size, 2016 - 2025 (USD Million)

TABLE 42 Canada edge computing market, by technology, 2016 - 2025 (USD Million)

TABLE 43 EMEA edge computing market, 2016 - 2025 (USD Million)

TABLE 44 EMEA edge computing market, by vertical, 2016 - 2025 (USD Million)

TABLE 45 EMEA edge computing market, by organization size, 2016 - 2025 (USD Million)

TABLE 46 EMEA edge computing market, by technology, 2016 - 2025 (USD Million)

TABLE 47 U.K. edge computing market, 2016 - 2025, (USD Million)

TABLE 48 U.K. edge computing market, by vertical, 2016 - 2025 (USD Million)

TABLE 49 U.K. edge computing market, by organization size, 2016 - 2025 (USD Million)

TABLE 50 U.K. edge computing market, by technology, 2016 - 2025 (USD Million)

TABLE 51 Germany edge computing market, 2016 - 2025, (USD Million)

TABLE 52 Germany edge computing market, by vertical, 2016 - 2025 (USD Million) Million)

TABLE 53 Germany edge computing market, by organization size, 2016 - 2025 (USD Million)

TABLE 54 Germany edge computing market, by technology, 2016 - 2025 (USD Million)

TABLE 55 MEA edge computing market, 2016 - 2025, (USD Million)

TABLE 56 MEA edge computing market, by vertical, 2016 - 2025 (USD Million) Million)

TABLE 57 MEA edge computing market, by organization size, 2016 - 2025 (USD Million)

TABLE 58 MEA edge computing market, by technology, 2016 - 2025 (USD Million)

TABLE 59 Others edge computing market, 2016 - 2025, (USD Million)

TABLE 60 Others edge computing market, by vertical, 2016 - 2025 (USD Million) Million)

TABLE 61 Others edge computing market, by organization size, 2016 - 2025 (USD Million)

TABLE 62 Others edge computing market, by technology, 2016 - 2025 (USD Million)

TABLE 63 Asia Pacific edge computing market, 2016 - 2025 (USD Million)

TABLE 64 Asia Pacific edge computing market, by vertical, 2016 - 2025 (USD Million) Million)

TABLE 65 Asia Pacific edge computing market, by organization size, 2016 - 2025 (USD Million)

TABLE 66 Asia Pacific edge computing market, by technology, 2016 - 2025 (USD Million)

TABLE 67 China edge computing market, 2016 - 2025, (USD Million)

TABLE 68 China edge computing market, by vertical, 2016 - 2025 (USD Million) Million)

TABLE 69 China edge computing market, by organization size, 2016 - 2025 (USD Million)

TABLE 70 China edge computing market, by technology, 2016 - 2025 (USD Million)

TABLE 71 Japan edge computing market, 2016 - 2025, (USD Million)

TABLE 72 Japan edge computing market, by vertical, 2016 - 2025 (USD Million)

TABLE 73 Japan edge computing market, by organization size, 2016 - 2025 (USD Million)

TABLE 74 Japan edge computing market, by technology, 2016 - 2025 (USD Million)

TABLE 75 Latin America edge computing market, 2016 - 2025 (USD Million)

TABLE 76 Latin America edge computing market, by vertical, 2016 - 2025 (USD Million)

TABLE 77 Latin America edge computing market, by organization size, 2016 - 2025 (USD Million)

TABLE 78 Latin America edge computing market, by technology, 2016 - 2025 (USD Million)

List of Figures

FIG. 1 Market segmentation and scope

FIG. 2 Edge computing, 2016 - 2025 (USD Million)

FIG. 3 Edge computing - Value chain analysis

FIG. 4 Edge computing market - Porter’s five forces analysis

FIG. 5 Edge computing market - PEST analysis

FIG. 6 Edge computing market - Comparison between edge computing and cloud computing

FIG. 7 Edge computing market - Edge computing model

FIG. 8 Edge computing market, by vertical, 2016 & 2025

FIG. 9 Edge computing market, by organization size, 2016 & 2025

FIG. 10 Edge computing market, by technology, 2016 & 2025

FIG. 11 Edge computing market, by region, 2016 & 2025

FIG. 12 North America edge computing market - Key takeaways

FIG. 13 EMEA edge computing market - Key takeaways

FIG. 14 Asia Pacific edge computing market - Key takeaways

FIG. 15 Latin America edge computing market - Key takeaways